|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Low Cost Mortgage Refinance Options: A Comprehensive GuideRefinancing your mortgage can be a strategic move to lower your monthly payments and reduce the overall cost of your home loan. However, navigating the refinancing landscape requires understanding various aspects to find the best low-cost options available. Understanding Mortgage RefinanceRefinancing involves replacing your existing mortgage with a new one, often with better terms. It's crucial to assess whether refinancing aligns with your financial goals. Key Considerations

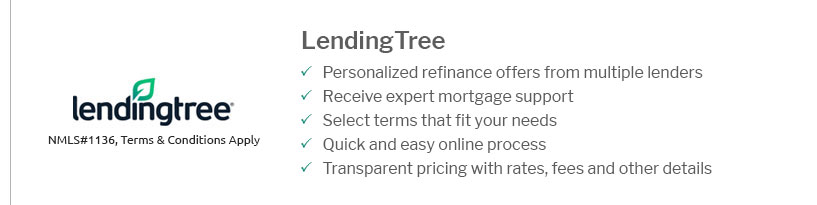

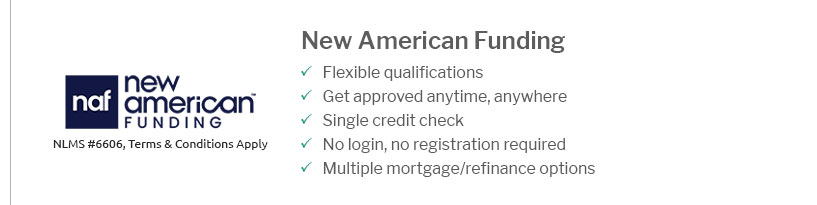

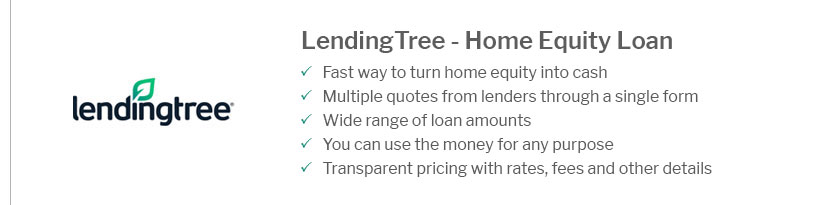

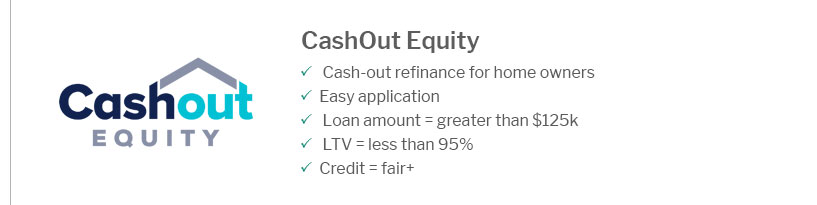

Finding the Best RatesExploring different lenders and loan options can lead to substantial savings. Consider checking mortgage rates today indiana to find competitive rates in your area. Comparing Lenders

Pro Tip: Use a mortgage calculator to estimate potential savings from refinancing. Low Cost Refinance OptionsSome refinancing options may offer low or no closing costs, which can make them appealing if you're looking to minimize upfront expenses. FHA Streamline RefinanceThis option is available for homeowners with an existing FHA loan. It's designed to simplify the refinancing process with less paperwork and no appraisal requirement. Learn more about fha loan down payment options. No Closing Cost RefinanceSome lenders offer refinance options without closing costs. While this can be attractive, it's important to ensure that the interest rate isn't significantly higher, which could offset any savings. FAQWhat is the ideal credit score for refinancing?Typically, a credit score of 620 or higher is ideal for refinancing. However, higher scores can secure better rates. How often can I refinance my mortgage?There is no legal limit on how often you can refinance, but it's wise to evaluate if the savings outweigh the costs each time. Can I refinance if my home has lost value?Yes, options like the FHA Streamline Refinance allow you to refinance even if your home has decreased in value. https://money.com/best-mortgage-refinance/

Bank of America Best for Member Discounts; Better Best for Fast Closing Time; loanDepot Best for Online Mortgage Refinancing; Nationwide ... https://www.bankofamerica.com/mortgage/refinance/

Today's competitive refinance rates ; Rate - 6.750% - 5.875% ; APR - 6.949% - 6.153% ; Points - 0.887 - 0.647 ; Monthly payment - $1,297 - $1,674. https://finance.yahoo.com/personal-finance/mortgages/article/best-mortgage-refinance-lenders-161445533.html

Truist offers sample mortgage refinance rates with one or zero discount points. That helps you make a decision on whether buying points makes ...

|

|---|